This web page is designed to provide information to help you make an informed decision on the April 1, 2025, non-recurring Operational Referendum for the Salem School District.

VOTE APRIL 1, 2025!

Please watch this video of our March school board meeting. It’s a great resource for understanding key issues and Salem School District's decision making process. Listed below are the time frames at which you will find the following information regarding the most frequently asked questions:

4:40: Legislative Advocacy

Discussion regarding our day at the State Capitol on March 12

10:30: Deep Dive into FAQs from our Community

• Board Responsibilities + Decision Making Overview

• School Finance and Budget Management

• Funding Challenges

• Referendum Breakdown

• Deep dive into your property tax bill

• Info as to why this referendum will NOT increase your taxes

Salem families and community—this is our school, our students, and our future. We are incredibly thankful for the amazing students, staff, families, and community members who make Salem such a special place, and we are proud to be a part of it. This video highlights the importance of the upcoming operational referendum on April 1st. Thank you for being part of the Salem family!

Building Bright Futures for Salem Students

OPERATIONAL REFERENDUM: APRIL 1, 2025

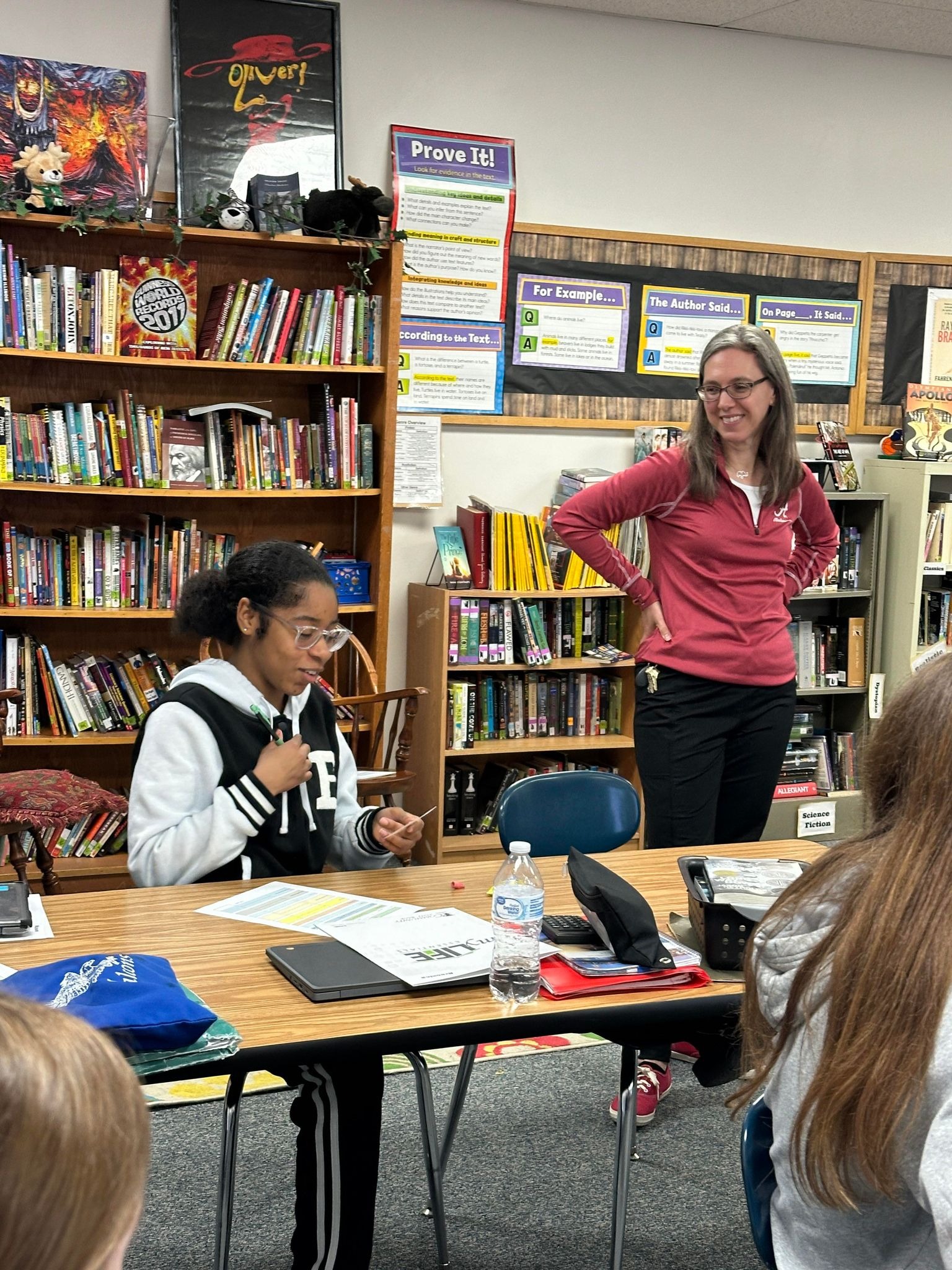

In the Salem School District, we are proud of the academic and co-curricular opportunities we provide our students. This is made possible thanks to our outstanding teachers and staff, supportive community, and strong financial discipline.

However, like many school districts statewide, we are facing the challenges of rising costs, an inequitable state school funding formula, and a lack of state aid to public schools in recent years.

Considering these challenges, the district has worked to make budget reductions and make the most of every single dollar taxpayers invest in their local schools. However, we believe the time has come to find a more sustainable solution to our financial needs.

Ballot Question

The question will appear on the ballot on April 1 as follows:

"Shall the Salem School District, Kenosha County, Wisconsin be authorized to exceed the revenue limit specified in Section 121.91, Wisconsin Statutes, by $2,000,000 per year for three years, beginning with the 2025-2026 school year and ending with the 2027-2028 school year, for non-recurring purposes consisting of ongoing operational expenses, including educational programming?"

What Happens if I vote Yes or No?

The referendum election ballot will ask District electors to vote "yes" or "no" on the referendum election question as set forth above.

A "yes" vote on the question is a vote to authorize the Salem School District budget to exceed the revenue limit specified in Section 121.91, Wisconsin Statutes, by $2,000,000 per year for three years, beginning with the 2025-2026 school year and ending with the 2027-2028 school year, for non-recurring purposes consisting of ongoing operational expenses, including educational programming.

A "no" vote on the question is a vote to deny the Salem School District the authority to exceed the revenue limit specified in Section 121.91, Wisconsin Statutes, by $2,000,000 per year for three years, beginning with the 2025-2026 school year and ending with the 2027-2028 school year, for non-recurring purposes consisting of ongoing operational expenses, including educational programming.

My child is open enrolled into Salem, can I vote on the referendum?

If your child is open enrolled into Salem School, that would mean that you live outside the Salem School District boundaries, and our referendum question won’t appear on your ballot. However, you can still support our efforts to inform the community by helping spread the word to others who do live within the district and may not be aware of the April 1st vote.

Frequently Asked Questions

Proposed Solution

On Tuesday, April 1, 2025, our community will vote on a three-year, non-recurring operational referendum question for the Salem School District. If it is approved, the district will be able to raise its revenue limit by $2,000,000 per year, through the 2027-2028 school year.

With these funds, the district would prioritize:

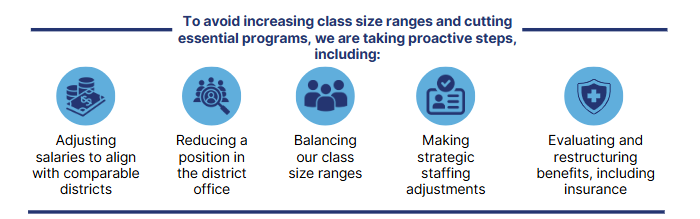

What has the District done so far to address these needs?

Considering our financial challenges, the Salem School District has worked diligently to control spending, make the most of our existing funds, and improve educational programming.

While these steps have helped reduce immediate financial pressures, they are not enough to ensure the long-term sustainability of our schools without additional funding.

Community Survey Results

In October 2024, the Salem School District conducted a community survey to assess our operational needs and gather feedback on potential solutions. We are grateful for the community's participation and would like to share the key findings:

Financial Challenges:

The district is facing a projected deficit of $72,299 for the 2024-25 school year, primarily due to rising costs and inadequate state funding.

Community Feedback:

The majority of respondents expressed support for exploring sustainable, long-term solutions to address the district's financial challenges.

Many community members emphasized the importance of maintaining the quality of educational programs and services.

There was a strong interest in being informed and involved in the decision-making process regarding potential referendums or other financial strategies.

We are committed to transparency and will continue to engage with our community as we navigate these challenges together. Your input is invaluable in ensuring that we can provide the best possible education for our students.

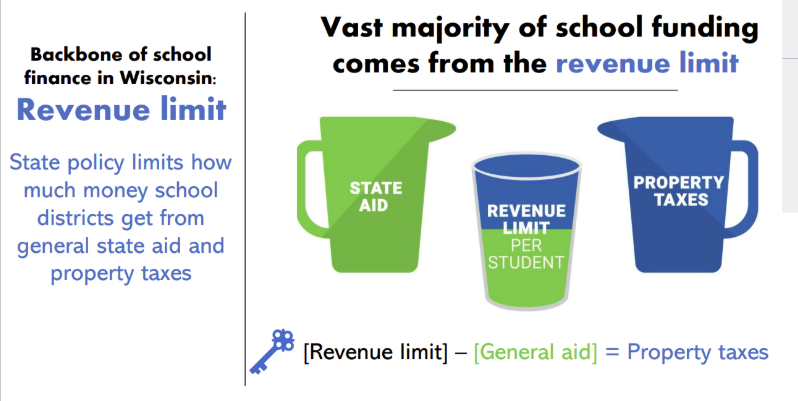

Where does a school district's revenue come from?

What is a Revenue Limit and how is it calculated?

A district's revenue limit is the maximum amount of revenue that can be raised through a combination of state general aid and local property taxes for specific funds:

Fund 10: General Operating Budget

Fund 38: Non-Referendum Debt

Fund 41: Capital Expansion

Revenue limits were established in the 1993-94 school year to control spending and tax increases. Each district’s per-pupil funding amount was initially based on its prior year’s per-student spending.

In 1992-93, Salem School’s per-student spending was below the state average. Since the revenue limit formula is built upon historical spending levels, this lower starting point has continued to impact us. As a result, we are still classified as a low-revenue school district today.

This historical funding gap highlights why continued advocacy and community support are essential to ensure our students have access to the same high-quality resources and opportunities as their peers across the state.

The property tax levy and general state aid comprise approximately 85% of Salem’s 2024-2025 Fund 10 (General) operating revenue.

These two amounts are determined by the revenue limit.

Community Connection

Where do I go to vote?